Choose Business Sector

-

Captive Risk Solutions

Learn More -

Collection Protection

Learn More -

Construction Risk Solutions

Learn More -

Dental Risk Solutions

Learn More - General/office liability

- HIPAA defense coverage

- Professional liability for you, your staff and your corporation

- Employment practices liability coverage- defense coverage included, indemnity provision available

- Contractual liability

- Occurrence and claims-made coverage forms available, allowing you to choose what best fits your needs

- State board/licensure coverage

- First aid/medical payments

- And much more!

-

Elder Care Risk Solutions

Learn More -

Employee Benefits

Learn More -

Energy Risk Solutions

Learn More -

Enterprise Insurance for Small Business

Learn More -

Financial Institutions Risk Solutions

Learn More -

Franchise

Learn More -

Healthcare Risk Solutions

Learn More -

Hospitality Risk Solutions

Learn More -

HR Consulting Risk Solutions

Learn More -

Human Services Solutions

Learn More - Adoption Agencies

- Behavioral Healthcare Organizations

- Child Care Centers

- Community Centers

- Developmental Disabilities Providers

- Group Homes

- Home Health Care

- Homeless / Battered Shelters

- Mental Health Organizations

- Non-Profit Organizations

- Religious Organizations

- Social Service Organizations

- Substance Abuse Rehabilitation Facilities

- Theaters

- YMCA / YWCA / YSO

-

Life Asset

Learn More -

Loss Control

Learn More -

Manufacturing Risk Solutions

Learn More -

Marine Risk Solutions

Learn More -

Municipalities Risk Solutions

Learn More -

Real Estate Risk Solutions

Learn More -

Seafood Risk Solutions

Learn More -

Surety & Bond

Learn More -

Technology/Life Science

Learn More -

Theatre, Arts, Culture, & Entertainment Risk Solutions

Learn More -

Transportation Risk Solutions

Learn More

Captive Risk Solutions

Through our partnership with Innovative Captive Strategies (ICS), Starkweather & Shepley can provide general information about Captive Insurance and help you explore whether it might be a suitable option for your business. A Captive Insurance Company is a specialized insurance company established to insure or reinsure the retained risk of its owners. It serves as a risk financing alternative to traditional insurance, offering businesses additional strategies to manage certain exposures.

Collection Protection

We provide insurance options developed with collectors’ needs in mind.

Through the Hanover Group, Starkweather & Shepley Insurance offers a variety of coverage solutions for individual collectors and dealers, designed to address the unique considerations of valuable collections.

Construction Risk Solutions

Construction has been a primary focus for Starkweather & Shepley since 1879.

Innovative risk management programs, practical guidance, tailored coverage options, and responsive service for construction projects – it’s the level of support you can expect from a broker who listens.

Starkweather & Shepley understands the risks associated with construction projects. While adequate coverage is important, managing costs and helping mitigate potential exposures are key priorities. We work with you to explore insurance and risk management options relevant to your construction business.

Ready to talk about Construction Risks?

Dental Risk Solutions

Professional liability insurance is available through the Professional Protector Plan ®, one of the oldest and largest dental professional liability programs in the country. The Professional Protector Plan provides coverage options, claim support, legal resources, and risk management training designed to help dental professionals manage potential exposures and enhance their practice operations.

Base coverage features include:

Elder Care Risk Solutions

Starkweather & Shepley’s Eldercare Risk Solutions focuses on providing insurance and risk management resources for nursing homes, rehabilitation facilities, and assisted living homes. Our team offers programs and educational resources designed to help organizations address common risk exposures and explore coverage options that complement standard policies.

Energy Risk Solutions

Starkweather Energy Risk Solutions focuses on insuring Fuel Oil Dealers, Propane Dealers, C-Store Operators, Gasoline Haulers, HVAC Service and Installation companies, Solar Installers, and businesses that sell kerosene or wood pellets. Our team offers guidance and resources to help energy-related businesses explore risk management options, with the goal of supporting safer operations and informed decisions for your organization.

Financial Institutions Risk Solutions

The Financial Institutions Practice Group works with established firms, start-ups, and breakaway organizations within the financial community to explore their insurance options and provide guidance on potential risk management strategies. We leverage our market relationships to help clients access coverage options that may support the management of operational risks.

Franchise

Franchisors, franchisees, and associations each have insurance needs and significant investments to protect. Starkweather & Shepley offers programs designed to help organizations and franchises leverage potential buying power. Franchisees and association members may have access to broader coverage options, competitive rates, and the claims support provided by established national carriers through franchise or affinity group programs.

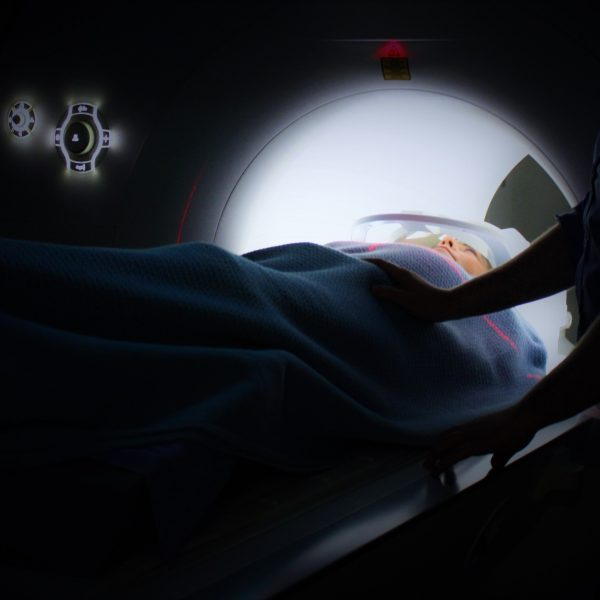

Healthcare Risk Solutions

Professionals in the healthcare field face unique risks, with critical decisions and careful oversight affecting daily operations.

Starkweather Healthcare Risk Solutions provides insurance programs, resources, and educational materials designed to help healthcare organizations and medical professionals explore risk management options and make informed decisions.

Human Services Solutions

Starkweather Human Services Solutions was established to support key segments of the Not-For-Profit human services community in their quest to access a wide range of risk management and insurance products offered by industry leading carriers.

Starkweather Human Services Solutions focuses on the following human services Industry segments:

Life Asset

We assist clients in exploring executive benefit and personal insurance options. Our consultants and business partners work with individuals, private practices, and corporations of various sizes and industries to review available plans and help identify approaches that may support their financial and coverage goals.

We provide guidance on developing strategic programs designed to address coverage needs and potential cost considerations. By reviewing available options, we aim to help clients make informed decisions aligned with their objectives.

Manufacturing Risk Solutions

Starkweather & Shepley was founded in 1879 by James Starkweather, a manufacturer, and George Shepley, an insurance professional. From the very beginning, our firm was rooted in an understanding of the challenges manufacturers face, combining industry experience with insurance expertise to provide practical options for clients in the manufacturing sector.

Marine Risk Solutions

As a Rhode Island-based firm, Starkweather & Shepley is well-positioned to provide guidance and insurance solutions for the marine industry, leveraging our local knowledge and experience in coastal and waterfront risks. Our Claims Unit provides guidance and support to help navigate claims efficiently and effectively.

Municipalities Risk Solutions

Running a municipal organization can be challenging, which is why working with an experienced insurance broker can make a difference. Since 1879, Starkweather & Shepley has worked with municipalities to help them explore coverage options and risk management strategies for their operations.

Real Estate Risk Solutions

The Real Estate Team is structured to provide focused support for your operations. Team members offer guidance on coverage options and risk management considerations, allowing you to concentrate on managing your business and portfolio. Through a consultative approach, the team helps clients make informed decisions and gain a clearer understanding of their insurance and risk management options.

Theatre, Arts, Culture, & Entertainment Risk Solutions

For theater owners and operators, having appropriate insurance coverage and a thoughtful risk management approach can help support ongoing operations. Starkweather & Shepley works with theaters, theater companies, and not-for-profit performing arts organizations to explore coverage options for their various exposures.

Our Theater Insurance programs can address a range of needs, including people, property, productions, administration, and financing. We work with clients to develop risk protection strategies for areas such as Dance Liability, Opera, or Performing Arts coverage, helping organizations plan for the many aspects of their operations.

Transportation Risk Solutions

Starkweather & Shepley works with trucking operations and auto dealerships to explore risk management and insurance options that may help address their operational and regulatory needs.

We have experience supporting local and intermediate trucking operations and auto dealerships, providing guidance on coverage considerations, Federal and State filings, and understanding how DOT compliance can influence your insurance program.