State of the Florida Marketplace

It’s a tough time to be a homeowner in Florida; the insurance market stands at a critical juncture influenced by a confluence of climate risks, regulatory changes, inflation, and consumer expectations. We are approaching what appears to be an active hurricane season driven by higher-than-average temperatures in the coastal waters of the Atlantic, Caribbean, and Gulf — at the writing of this article, five active systems are forming, with more to come. These weather-related pressures are unfortunately only amplified by economic pressures — Florida accounts for 9% of the country’s homeowners’ claims, but 79% of total homeowners insurance lawsuits. Recent legislature was put into place to prevent frivolous lawsuits, but largely speaking, legislators have done too little too late to stem the tides of meteoric premium increases for its populace.

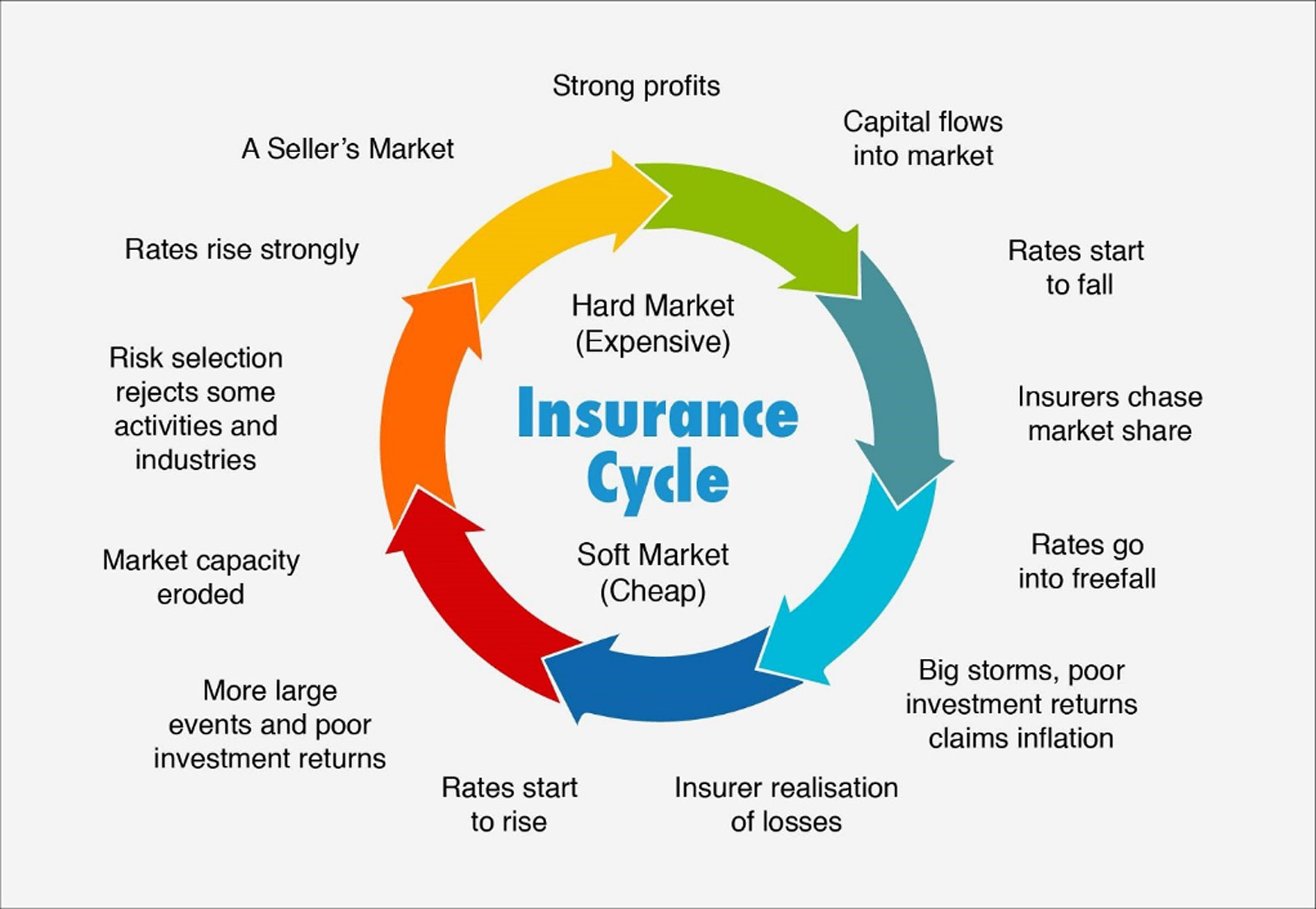

Source: https://www.b4-business.com/article/insurance-in-a-hard-market-what-it-means-for-your-business/

Here are some of the recent headlines you may be aware of:

- Citizens, considered a not-for-profit government entity put into place as a market of last resort owned and operated by the state, has become inundated with demand surge of $1M+ homes as a result of carriers pulling out of the market. This market is not a comprehensive solution for most risks.

- Fifteen insurers have stopped writing new business in FL since 2022. Farmers and Travelers were just added to this list.

- Seven insurers declared insolvency since February 2022, and 14 are in liquidation, including United Property & Casualty Insurance Company. St. Petersburg-based United Property & Casualty, which was ordered into receivership this past February, had about 135,000 policies in Florida. Some policies are being transferred to Slide Insurance, although they are not responsible for prior unpaid claims, which are being addressed through the Florida Insurance Guarantee Association (FIGA).

All this said, our experience in the marketplace allows us to lend some best practices for making the best insurance decisions in a challenging environment.

Do’s:

- Consider increasing hurricane and all other peril deductibles for cost savings.

- Install protection devices to make your home more resilient to loss. Examples can include storm shutters, impact-rated glass, whole home generators, lightning suppression systems, water leak detection and shutoff valves, and many more.

- Confirm the financial rating, size, and rating platform of your current insurer.

- Understand the pros and cons of admitted vs. non-admitted coverage.

- Understand the difference between hurricane and named storm deductibles.

- Recognize that underinsurance after a total loss is a common problem, more so in a high inflation environment and during times of demand surge (e.g.: post large-scale weather events).

Hurricane Ian Slams Into West Coast Of Florida, Source: https://www.bloomberg.com/opinion/articles/2022-10-11/after-hurricane-ian-build-back-different#xj4y7vzkg

Don’ts:

- Switch carriers for small savings – carriers are constantly taking rates and trading back and forth as far as the most competitive. Carrier tenure is more important than ever, and you will have greater consideration if carriers elect to non-renew a portion of the policies on their books.

- Submit small losses – generally speaking, in a hard market, carriers are more sensitive than ever to claims activity. This is why it makes sense to take a higher deductible and transfer risk only for major events. Insurance policies should not be utilized for deferred maintenance. Before submitting a claim speak to your Advisor regarding the potential long-term effects a claim might have on your insurability and pricing.

- Trade your admitted insurance solution for a non-admitted (Excess and Surplus) option without weighing the pros and cons. There are some instances where it makes sense, including if your admitted carrier is at risk of insolvency – these cases should be discussed with your Advisor. Admitted carriers are also limited in the amount they can increase their premiums at each renewal, whereas non-admitted are ungoverned.

In short, the already complex FL insurance marketplace is more nuanced than ever. Unlike other markets across the country, missteps cannot always be backtracked. I invite you to contact our personal insurance team to help navigate this treacherous environment.

Written by:

Thomas DiCarlo

Personal Lines President, Starkweather & Shepley